Introduction

In the bustling real estate landscape of Manhattan, New York, the role of a commercial property appraiser is crucial. As one of the most competitive and lucrative markets in the world, Manhattan’s commercial properties require expert evaluation to determine their value accurately. This article delves into the responsibilities, qualifications, and significance of commercial property appraisers in Manhattan, NY, while also discussing the challenges they face and the trends shaping the industry.

What is a Commercial Property Appraiser?

A commercial property appraiser is a professional who assesses the value of commercial real estate properties, which may include office buildings, retail spaces, industrial properties, and multi-family units. Their evaluations are essential for various stakeholders, including buyers, sellers, lenders, investors, and government agencies. The appraiser provides an unbiased opinion of value, which is critical for making informed decisions in the real estate market.

The Importance of Commercial Property Appraisals

- Financing and Lending: One of the primary reasons for obtaining a commercial property appraisal is to secure financing. Lenders require appraisals to ensure that the property’s value aligns with the loan amount. A thorough appraisal helps mitigate risks for lenders and ensures that they are not overextending credit.

- Investment Decisions: Investors rely on Block Appraisals to make informed decisions about purchasing or selling properties. An accurate appraisal helps investors understand the potential return on investment (ROI) and the risks involved in a particular property.

- Tax Assessments: Property appraisals play a significant role in tax assessments. Local governments use appraised values to determine property taxes. A well-conducted appraisal can help property owners contest unfair tax assessments.

- Market Analysis: Appraisers provide valuable insights into market trends and property values. Their assessments can help stakeholders understand the dynamics of the market, including supply and demand, which can influence pricing strategies.

Qualifications of a Commercial Property Appraiser

To become a commercial property appraiser in Manhattan, one must meet specific educational and professional requirements:

- Education: Most appraisers hold a bachelor’s degree in fields such as finance, real estate, economics, or business administration. Advanced degrees and specialized coursework in appraisal theory and practice can enhance an appraiser’s qualifications.

- Licensing and Certification: In New York, appraisers must be licensed or certified by the New York State Board of Real Estate Appraisers. This process involves completing a certain number of hours of appraisal education, gaining practical experience under a licensed appraiser, and passing a state examination.

- Experience: Experience is a critical component of becoming a successful commercial property appraiser. Many appraisers start their careers as trainees, working alongside experienced appraisers to gain hands-on knowledge of the industry.

- Professional Organizations: Joining professional organizations such as the Appraisal Institute or the American Society of Appraisers can provide additional resources, networking opportunities, and continuing education, which are essential for career advancement.

The Appraisal Process

The appraisal process typically involves several key steps:

- Property Inspection: The appraiser conducts a thorough inspection of the property, noting its size, condition, location, and any unique features. This step is crucial for gathering firsthand information that will influence the property’s value.

- Data Collection: Appraisers collect data on comparable properties in the area, known as “comps.” This data includes recent sales prices, rental rates, and market trends. Understanding the local market is essential for accurate valuation.

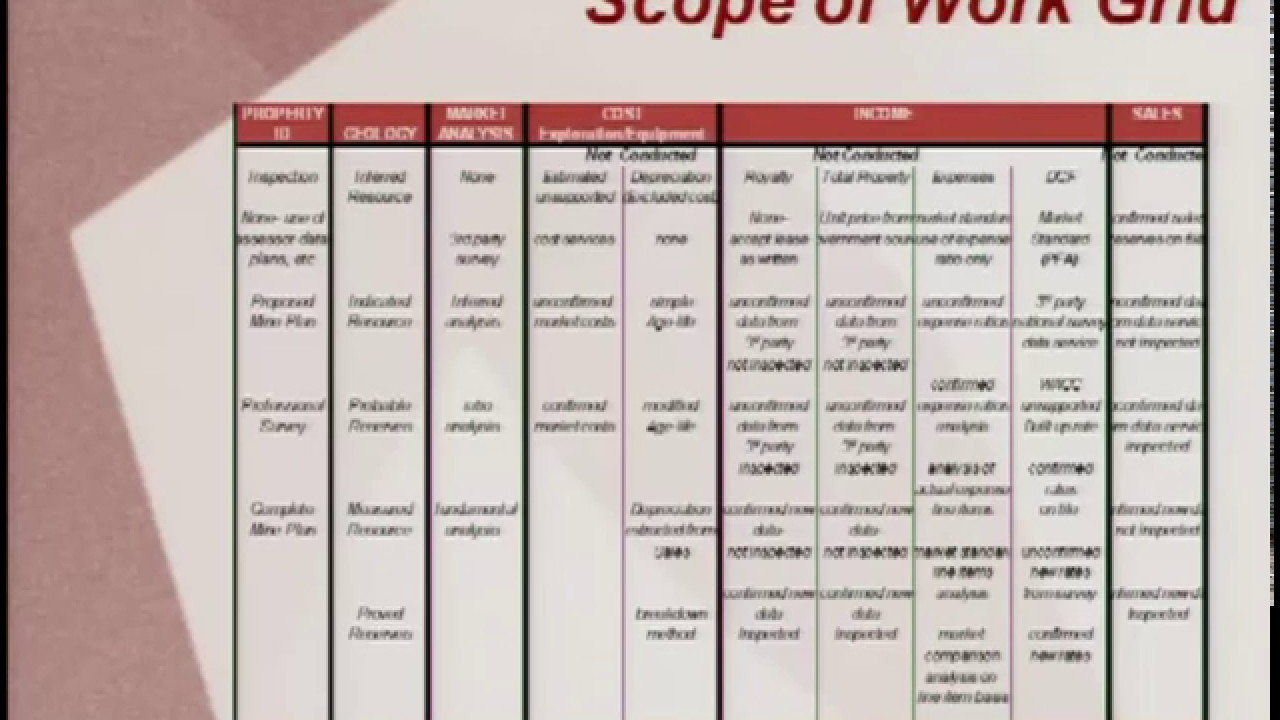

- Valuation Methods: Appraisers utilize various methods to determine a property’s value, including:

– Cost Approach: This method estimates the value based on the cost to replace or reproduce the property, minus depreciation.

– Sales Comparison Approach: This approach compares the subject property to similar properties that have recently sold in the area.

– Income Approach: Often used for income-generating properties, this method calculates value based on the expected income the property can generate.

- Report Preparation: After conducting the appraisal, the appraiser prepares a detailed report that outlines their findings, methodology, and final valuation. This report is critical for stakeholders who rely on it for decision-making.

Challenges Faced by Commercial Property Appraisers

- Market Volatility: The real estate market in Manhattan is known for its volatility, influenced by economic factors, interest rates, and demand fluctuations. Appraisers must stay informed about market trends to provide accurate valuations.

- Complex Regulations: Navigating the complex regulatory environment in New York can be challenging for appraisers. They must comply with local, state, and federal regulations, which can vary significantly.

- Technological Advancements: The rise of technology in the real estate industry has transformed how appraisals are conducted. Appraisers must adapt to new tools and software that streamline the appraisal process while maintaining accuracy.

- Client Expectations: Appraisers often face pressure from clients who may have differing opinions on property value. Balancing professional integrity with client expectations can be a delicate task.

Trends Shaping the Commercial Appraisal Industry in Manhattan

- Sustainability and Green Building Practices: As sustainability becomes a priority in real estate, appraisers must consider the value of green buildings and energy-efficient features. Properties with sustainable practices may command higher valuations due to increasing demand.

- Remote Work Impact: The shift towards remote work has altered the demand for office space in Manhattan. Appraisers must analyze how this trend affects property values and the overall commercial real estate landscape.

- Technology Integration: The integration of technology in the appraisal process, such as automated valuation models (AVMs) and data analytics, is changing how appraisers conduct evaluations. Embracing these technologies can enhance efficiency and accuracy.

- Market Diversification: The diversification of commercial properties, including mixed-use developments and co-working spaces, presents new challenges and opportunities for appraisers. Understanding these evolving property types is essential for accurate valuation.

Conclusion

The role of a commercial property appraiser in Manhattan, NY, is vital in navigating the complexities of the real estate market. With a combination of education, experience, and a keen understanding of market dynamics, appraisers provide invaluable insights that help stakeholders make informed decisions. As the industry continues to evolve, appraisers must adapt to new trends, technologies, and challenges to maintain their relevance and effectiveness in this competitive market.

In summary, whether you are a lender, investor, or property owner, understanding the importance of commercial property appraisals and the expertise of appraisers can significantly impact your real estate endeavors in Manhattan.